Liquid Staking Unveiled: A Comprehensive Guide with Google Bard

Maximizing Crypto Investment Returns through Liquid Staking Strategies

As a crypto investor, you're likely no stranger to the allure of potentially lucrative ventures. Recently, liquid staking has piqued your interest. The promise of increased liquidity and flexibility makes it an intriguing proposition, but the risks, including the potential loss of staked ETH, are not lost on you.

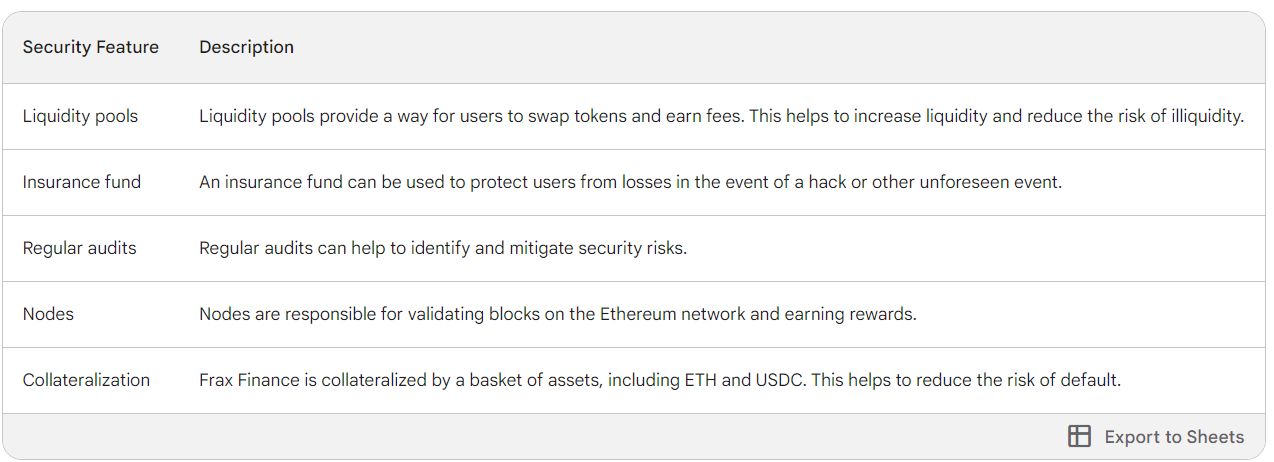

To make an informed decision, you turn to Google Bard, your trusty guide in the intricate world of cryptocurrency. Bard deciphers the complex topic of liquid staking, explaining it as a means of staking ETH that also allows it to be used as collateral. This opens up a world of possibilities: earning yield on your ETH, borrowing funds, and participating in other DeFi protocols.

The next step on your journey is understanding the various liquid staking protocols available. Google Bard, akin to a digital librarian, presents a list of the most popular protocols, each with its unique features, advantages, and drawbacks.

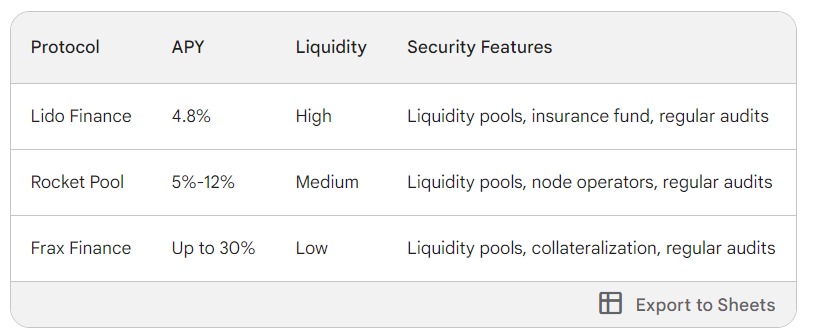

Your attention is drawn to three protocols in particular: Lido Finance, Rocket Pool, and Frax Finance. Eager to delve deeper, you ask Bard for detailed information about these three contenders. Like a proficient analyst, Bard delivers a comprehensive breakdown of each protocol’s APY, liquidity, and security features, effectively laying out the groundwork for your decision.

After meticulous scrutiny, you find Lido's offering to be the most balanced, considering your own risk tolerance and expected returns. With its robust security features, competitive APY, and ample liquidity, Lido Finance stands out among the contenders.

Convinced by your findings, you decide to take the plunge, staking your ETH with Lido to receive stETH in return. This calculated decision marks the first step of your liquid staking journey.

Armed with newfound knowledge, you and Bard now undertake the task of backtesting various liquid staking strategies. Your aim? To gauge the performance of these strategies under different market scenarios. Bard conjures up multiple scenarios, while you, the seasoned strategist, pore over the results.

The backtests shed light on an intriguing possibility: the total yield could potentially be amplified by leveraging your liquid staking token through Pendle Finance. But, a specter looms: if ETH prices plunge, liquidation could rob you of your collateral.

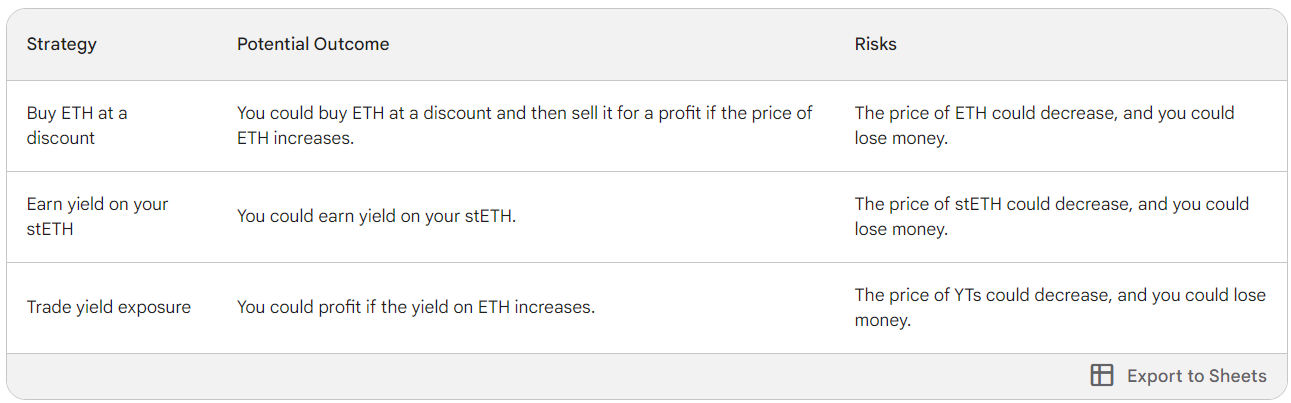

Buoyed by the findings of your backtests, you craft your strategy. Three distinct approaches emerge: buying ETH at a discount, earning yield on your stETH, and trading yield exposure. Each strategy has its unique potential outcomes and the choice of the best one hinges on your individual trading goals and risk appetite

Driven by the insights from backtests, Bard sketches a plan of action, detailing three potential strategies:

Strategy 1 - Buying ETH at a Discount Using Pendle Finance: You begin with an initial investment of 10 stETH tokens and a current ETH price of $1,736.50. By depositing your stETH tokens into the stETH pool on Pendle Finance, you can mint 10 PTs (Principal Tokens) and 10 YTs (Yield Tokens). The value of the PTs would be equivalent to your initial investment of 10 stETH. You could sell your YTs, which represent the yield, and use the proceeds to reinvest in ETH. Now, if the price of ETH rises to $2,000 within the year (the maturity period), your profit would be the difference between the final and initial prices of ETH multiplied by the number of ETH tokens you hold. This would amount to ($2,000 - $1,736.50) * 10 = $2,635, equating to a profit percentage of about 15.17%.

Strategy 2 - Earning Yield on stETH: With an initial investment of 10 stETH, you could provide liquidity in Pendle's stETH pool. This pool is comprised of PT-stETH and stETH. By becoming a liquidity provider (LP), you would stand to earn from multiple sources.

Swap Fees: As transactions occur within the pool you've contributed to, a small fee is levied on each trade. As an LP, a portion of these fees would be distributed to you, proportional to your share in the pool.

PENDLE Incentives: Pendle rewards LPs with PENDLE tokens. The amount you receive would depend on your share of the liquidity pool.

PT-stETH Fixed Yield: When you provide liquidity with stETH, you mint PT-stETH. The PT-stETH will appreciate in value over time as it earns yield, eventually matching the value of the underlying stETH asset upon maturity.

stETH Staking Rewards: stETH itself earns staking rewards. As an LP, you would also earn these staking rewards.

Now, let's consider that the price of ETH increases to $2,000 within a year. The value of your liquidity position in the stETH pool would increase correspondingly, given that PT-stETH is redeemable 1:1 for stETH upon maturity. Furthermore, Pendle's design minimizes impermanent loss (IL). While there may be temporary IL due to fluctuations in the price of PT versus the underlying asset, there will be no IL at maturity, because PT will equal the underlying asset.

You also have the option to boost your APY by locking PENDLE for vePENDLE, which increases the yield you earn from your LP positions.

Let's estimate your potential profits with an assumed APY of 5%. The yield you would earn over a year is 10 stETH * 5% = 0.5 stETH, which equates to $1,000 (0.5 stETH * $2,000/ETH). In addition, the increase in the value of your initial investment due to the rise in ETH price would be (10 stETH * $2,000) - (10 stETH * $1,736.50) = $2,635. Your total profit would then be the yield plus the increase in the value of your initial investment, which equals $2,635 + $1,000 = $3,635. This reflects a profit percentage of ($3,635 / (10 stETH * $1,736.50)) * 100% = approximately 20.94%.

Strategy 3 - Trading Yield Exposure: Investing 10 ETH, you have the option to deposit this into Pendle and mint Principal Tokens (PT) and Yield Tokens (YT). Assuming a current implied yield of 6% in the yield exposure market, your potential returns will depend on your strategy:

Buying PT: In this case, you believe the yield on ETH will fall, so you decide to hedge your yield by buying PT. Let's say the current implied yield is 6%, and you have 10 ETH. You decide to spend all your 10 ETH on PT.

Upon maturity, you'll receive 1.06 ETH for every PT you bought. Therefore, if you invest your 10 ETH into PT, you'll get back 10 * 1.06 = 10.6 ETH upon maturity.

Now, suppose the yield does decrease by 10% over the course of the year. Despite this decrease, you're shielded from this loss because your return was locked in at 6% when you bought the PT. So, you'd still get back 10.6 ETH, effectively earning you a profit of 0.6 ETH compared to if you had held onto your ETH without buying PT.

Buying YT: In this scenario, you believe that the yield of ETH will rise. So, you decide to bet on your yield by buying YT. Let's assume the yield increases by 10% over the course of the year. This means the new yield would be 6% * 1.10 = 6.6%.

Since YT tokens represent the yield portion of your investment, the returns on your YT tokens will increase in line with this yield rise.

However, the exact return would depend on the price of YT and how much you could purchase with your 10 ETH. For example, if YT is priced at 5% of the ETH price, you could buy 20 times the amount of YT as ETH with the same amount of capital. So, if the yield increases by 10%, and YT price also increases proportionally, your return could potentially be 10% * 20 = 200%, subject to market dynamics and demand for YT.

Providing Liquidity: If you believe that the yield of ETH will be unlikely to fluctuate significantly, you can provide liquidity in Pendle's pools to earn some extra yield from swap fees and incentives.

The exact return would depend on the fees and incentives provided by the pool. For instance, if the pool offers a 2% return in swap fees and incentives over the year, and you provide 10 ETH worth of liquidity, you could potentially earn 10 ETH * 0.02 = 0.2 ETH over the year.

Additionally, providing liquidity to Pendle pools can also earn you PENDLE incentives, PT fixed yield, as well as any other rewards given by the underlying yield-bearing asset, adding more to your overall returns.

Each strategy has its unique potential outcomes and the choice of the best one hinges on your individual trading goals and risk tolerance.

Each strategy has unique potential outcomes, and the best one for you will depend on your individual trading objectives and risk tolerance. If you're looking to buy ETH at a potential discount and are comfortable with the risks, you might consider Strategy 1. However, if you are aiming to maximize your potential returns based on the given market assumptions, Strategy 2 seems to be the most profitable approach, where you earn yield on your stETH. Lastly, if you're interested in trading yield exposure, Strategy 3 presents an opportunity to trade YTs

Inspired by your success, you decide to share your experience with the wider crypto community. You craft a blog post recounting your liquid staking journey, including how you utilized Google Bard for learning and strategy development.

In your post, you emphasize the importance of thorough research before opting for a liquid staking protocol and caution readers about the inherent risks. You leave them with a final thought: despite the risks, you're glad you used Google Bard to navigate the waters of liquid staking, a tool you believe is invaluable for any crypto investor embarking on a similar voyage.